POS Integrations

Streamline verifications directly inside your point-of-sale.

Enable Truv within the point-of-sale of your choice.

Direct-to-source verifications.

Direct-to-source verifications.

Cost savings.

Faster processing.

Upfront data.

Compliance.

capture data upfront

Increase

conversions.

Add Truv to your loan application to collect pre-qualification information upfront.

See Truv

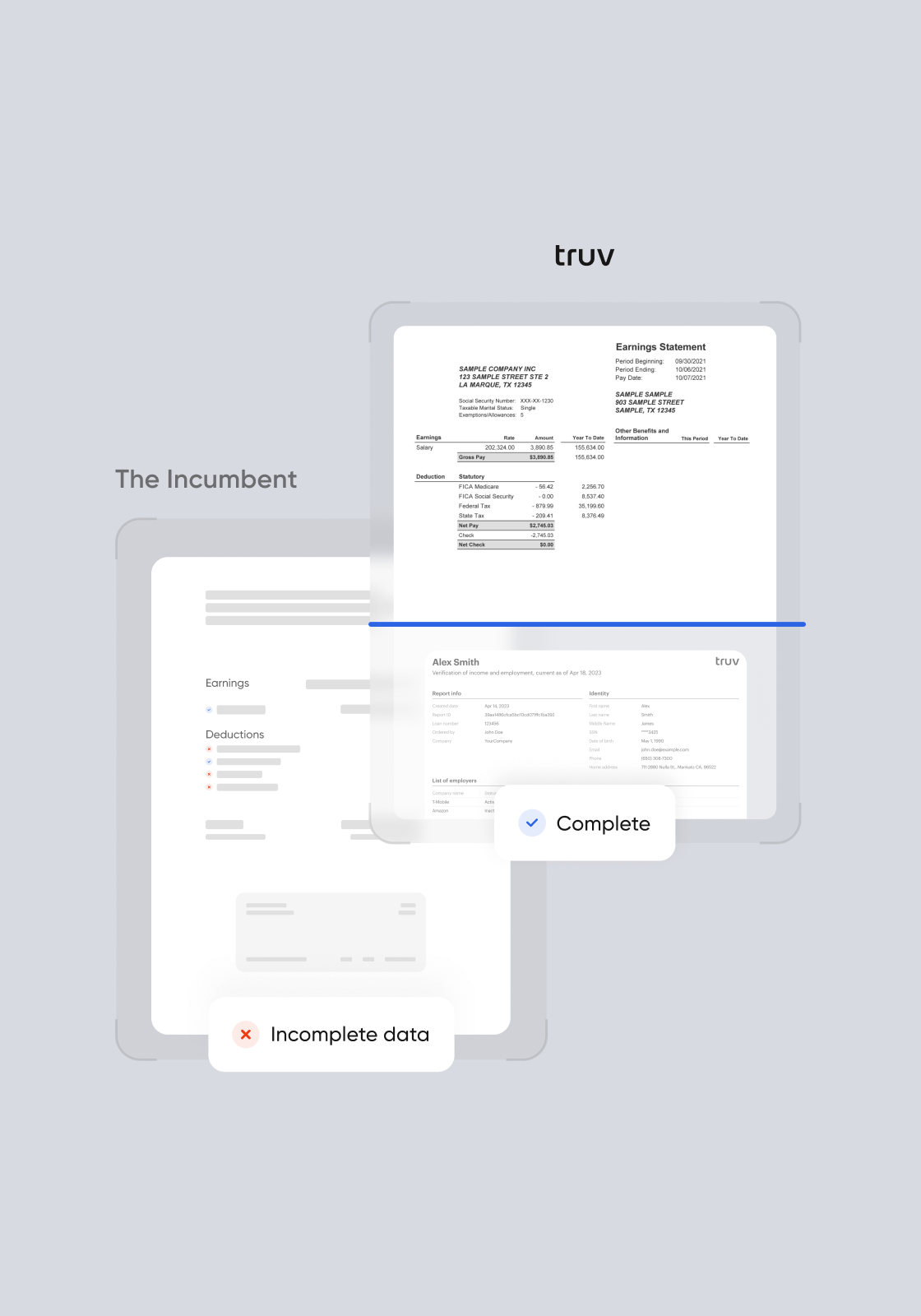

Cost savings

60-80% cost reduction.

Lenders leverage Truv’s direct-to-source data to minimize the cost of The Incumbent.

See Truv

reduce buybacks

Authorized reports for DU® and LPA®.

Truv VOIE reports are approved by Fannie Mae and Freddie Mac to use with DU and LPA.

Streamlined workflow

Minimize change management.

Embed Truv directly in your POS to automate verifications in the loan app.

See Truv

Faster PROCESSING

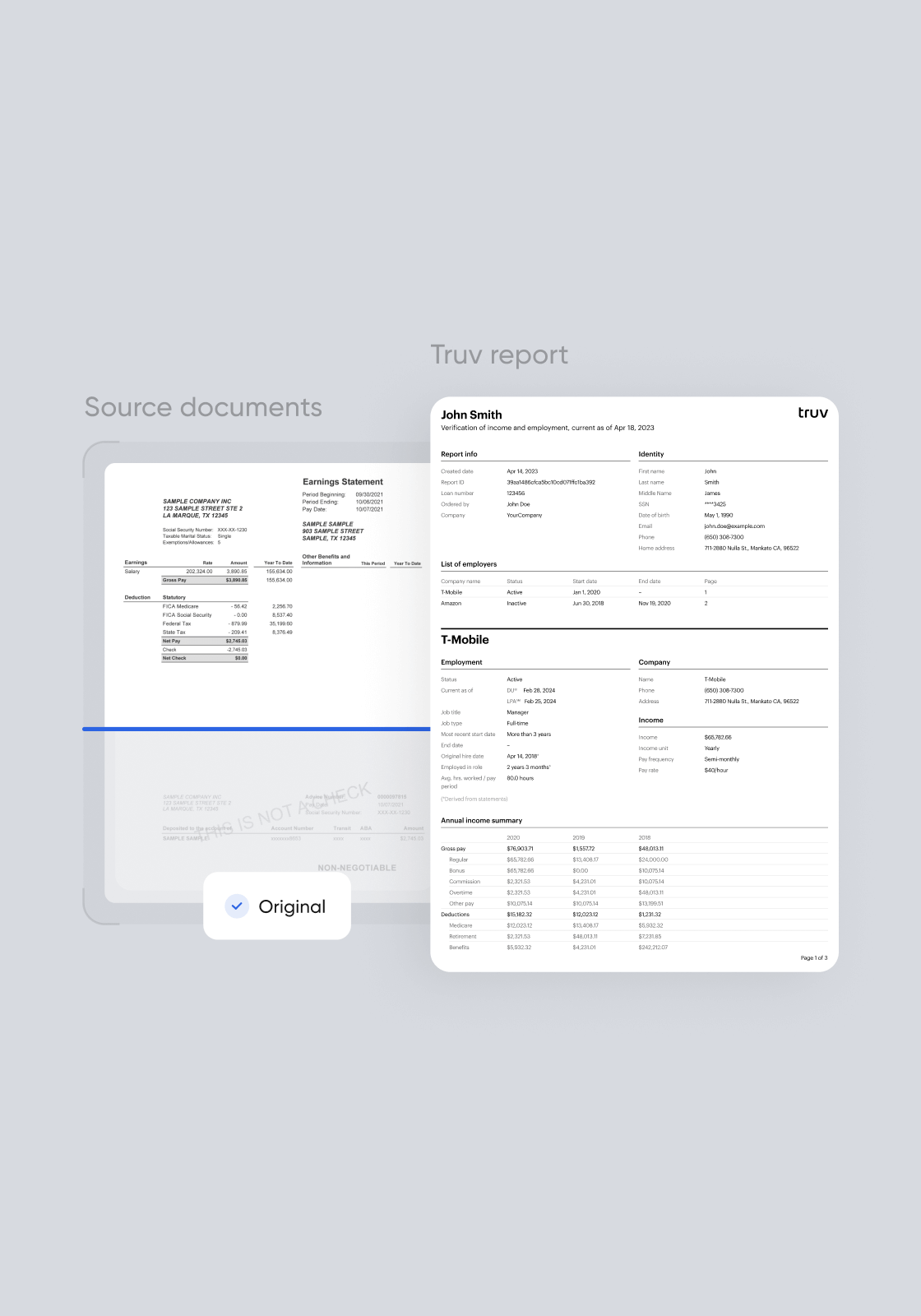

Streamline documentation collection.

Access the Truv report, paystubs, W-2s and 1099s, straight from the source.

See Truv Explore Truv’s point-of-sale integrations.

Explore Truv’s point-of-sale integrations.

Pre-qualify more borrowers in the 1003 with income, employment, and asset verifications.

Reduce manual verifications with embedded consumer-permissioned verifications.

Unlock lending efficiency with real-time income and employment verifications.

Embed income and employment verifications directly in your loan app.

Automate consumer-permissioned income and employment verifications.

Accelerate loan processing with direct-to-source income and employment verifications.

All-in-one platform for verifications.

All-in-one platform for verifications.

Products & Solutions

Payroll Income & Employment

Highest conversion rate and data fill rates in the industry.

Paystubs & W-2s

Best-in-class OCR and fraud detection for pay documents.

Bank Assets

Highest oAuth rate and insights into bank assets & cash flows.

Mortgage Lending

Accelerate loan closing & reduce buy backs.

Platform

Femi Ayi

Femi Ayi, EVP of Operations at Revolution Mortgage