Attributes

Reach new levels of predictive power.

Enhance accuracy of your risk models using transaction data.

Predict default rates in seconds.

Predict default rates in seconds.

data set

AI insights at scale.

Trained on over 20 million transactions covering a variety of consumer segments for a range of different risk outcomes.

See Truv

k-score

Unparalleled predictive power.

Understand your subprime, new-to-credit & under-served segments better.

See Truv

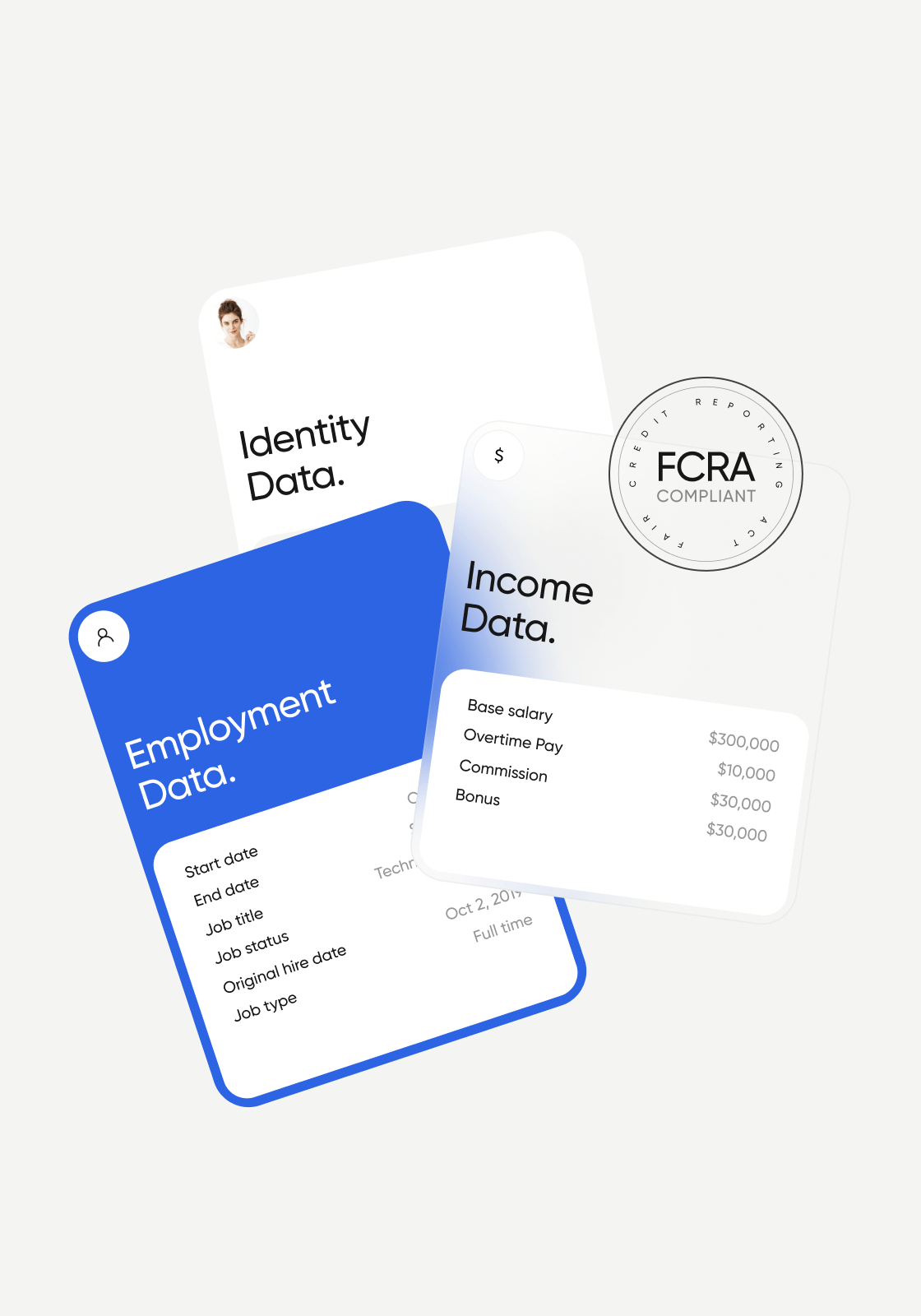

Quality

Fair Lending.

FCRA & ECOA compliant attributes which alleviate issue of disparate lending.

See Truv All-in-one platform for verifications.

All-in-one platform for verifications.

Scoring attributes FAQs.

Scoring attributes FAQs.

Consumer lenders and auto lenders.

Truv provides 2,200+ transaction-based attributes to enhance lenders’ risk models, offering insights into financial activity, repayment willingness, and loan qualification potential.

By analyzing over tens of millions transactions across consumer segments, Truv helps lenders predict default rates, reach underserved markets, and identify qualified applicants with low or no credit scores.

The platform includes a range of attributes, including: financial activity attributes, loan activity attributes, household expenditure attributes, balance attributes, and income-related attributes.

Truv eliminates manual data interpretation, provides comprehensive transaction insights, and offers FCRA-compliant attributes trained across diverse consumer segments.

Todd Rice

Founder & CEO at New Credit America