Home Equity Lending

Close more home equity loans, faster.

Verify income, employment, and insurance for home equity loans in minutes.

All-in-one platform for verification of income, employment and insurance.

All-in-one platform for verification of income, employment and insurance.

Maximize savings.

Accelerate approvals.

Verify all borrowers.

Why partner with Truv?

Why partner with Truv?

Bridge

Verify borrowers instantly.

User experience optimized for high conversion and minimum friction.

Learn more

Quality

Use real-time,

accurate data.

Direct to source data. Approved by Freddie Mac and Fannie Mae.

Learn more

Assets

Verify using bank accounts.

With over 13K+ financial institutions & AI- driven deposit detection.

Learn moreWaterfall

Use one platform

for all verifications.

Every method you need to verify 100% of borrowers.

Learn moreGrowth

Accelerate funded loans.

Best conversion rate in the industry. Higher NPS for customers who used Truv.

See Truv

Trusted Data

Reduce risk of income fraud.

Trusted data and documents directly from the source.

See TruvCost Savings

Maximize your savings.

Increase margins for every closed loan. Keep data access for up to 120 days.

See TruvIncreased Efficiency

Reduce manual verifications.

Less dependency on manual labor and fixed expenses.

See Truv All-in-one platform for verifications.

All-in-one platform for verifications.

Self-Employment Verification

Bank Assets

Highest oAuth rate and insights into bank assets & cash flows.

Platform

Home equity loans income verification FAQs.

Home equity loans income verification FAQs.

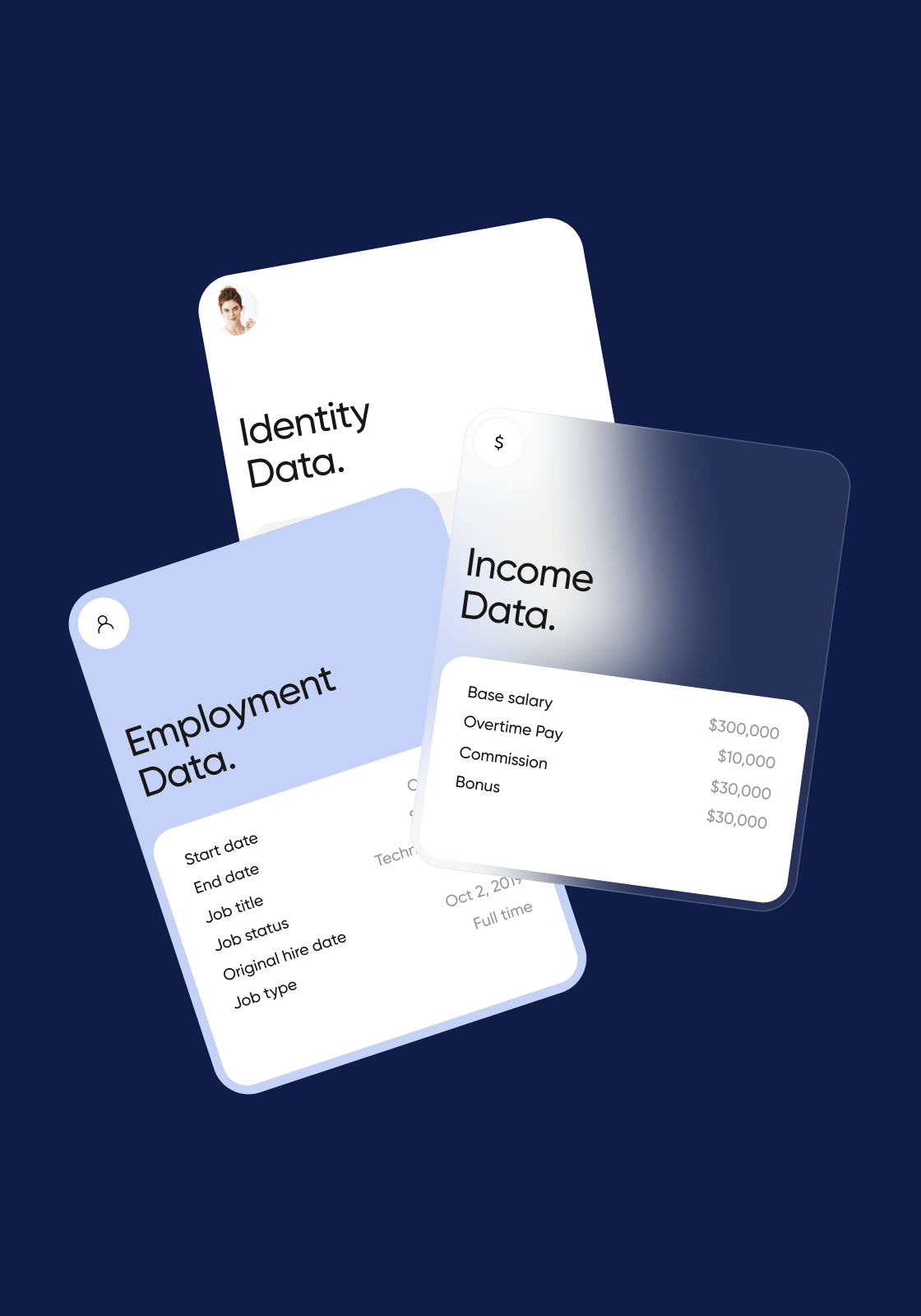

Truv offers comprehensive verification services for home equity lending, including income verification, employment verification, asset verification, and insurance verification. Our all-in-one platform streamlines the verification process for lenders.

Truv’s income verification is trusted by home equity lenders for high conversion rates, direct-to-source data, and operational efficiencies. We offer a comprehensive solution that covers various income sources and verification methods.

Truv’s employment verification for home equity loans uses real-time, accurate data directly from employers. Our platform can verify employment status quickly, reducing manual verifications and accelerating the loan approval process.

Truv Waterfall is our unified platform that combines multiple verification methods, ensuring lenders can verify 100% of borrowers. This comprehensive approach maximizes efficiency and reduces the need for manual verifications in home equity lending.

Truv provides trusted data directly from the source, significantly reducing the risk of income and employment fraud. Our platform includes advanced fraud detection capabilities, particularly for analyzing pay documents.

Yes, Truv offers integrations with major lending platforms, including Encompass LOS, Empower LOS, and BYTE Software. This allows for seamless incorporation into existing workflows.

Truv maximizes savings by reducing manual verifications, accelerating the time to close, and improving operational efficiency. Our platform can significantly increase margins on every closed loan.

Truv differentiates itself through: 1. Market leading conversion rates 2. Best-in-class coverage (96% of US workforce) and user experience 3. An all-in-one platform for various types of verifications (income, employment, assets, insurance) 4. Integrations with top Point of Sale (POS) and Loan Origination Systems (LOS) 5. Waterfall verification system to cover 100% of borrowers.

Truv ensures data accuracy by obtaining information directly from the source, whether it’s payroll providers, banks, or borrower-uploaded documents. This direct access, combined with AI-driven analysis and fraud detection, provides lenders with highly reliable verification data.

Yes, Truv provides API access for developers. They offer a quickstart guide, API documentation, and a quickstart repository to facilitate custom integrations for lenders who need specific solutions.

Jonathan Spinetto

COO & Co-Founder at NFTYDoor