Payroll

Verify income and employment with data from the source.

Maximize cost-saving and reduce risks with Truv payroll products.

Make informed underwriting decisions.

Make informed underwriting decisions.

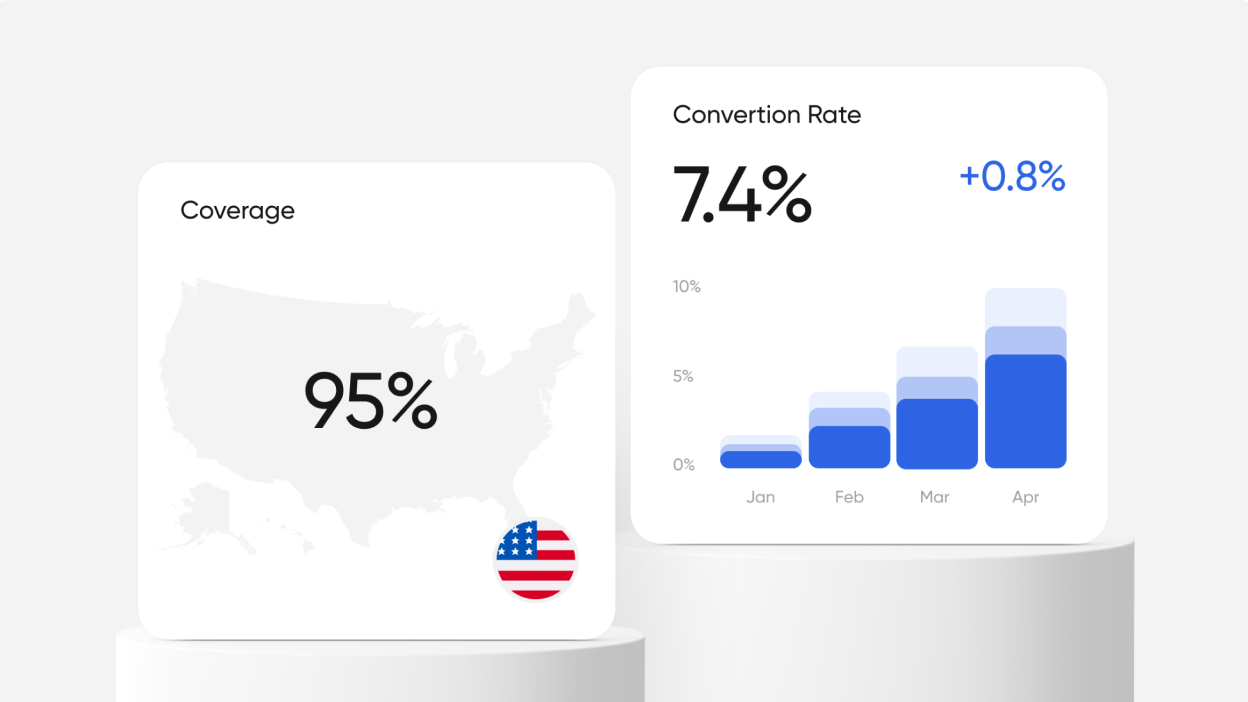

Coverage

Unmatched coverage.

158.5M+

Americans

covered.

2.3M

Employers

in Truv’s database.

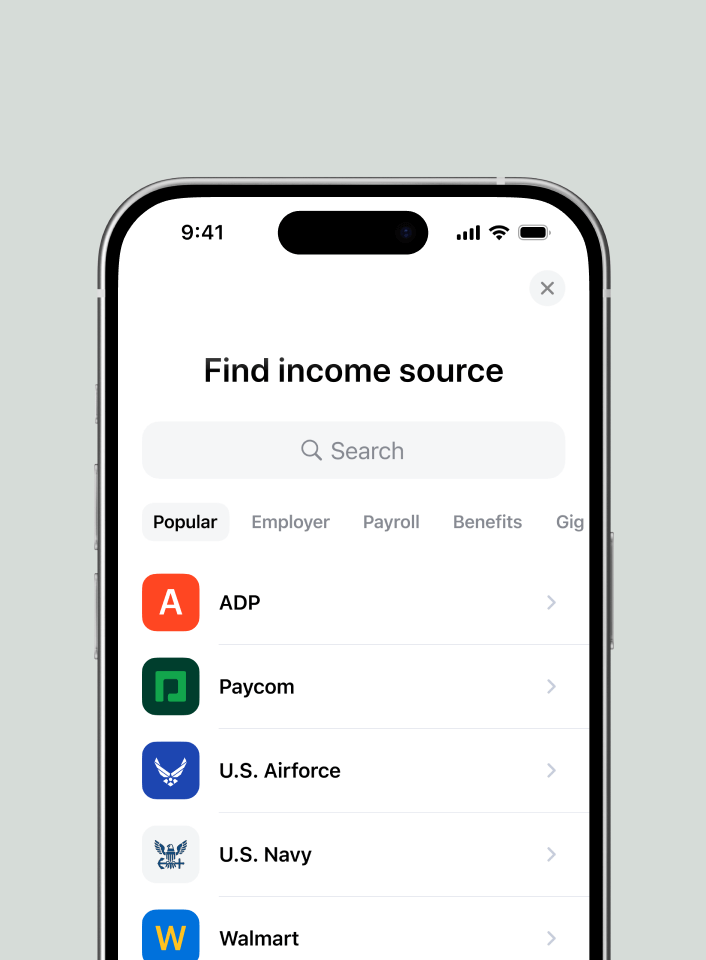

User Experience

Highest conversion rates.

289k+

Employers mapped

to payroll providers.

43

Unique single-sign

on integrations.

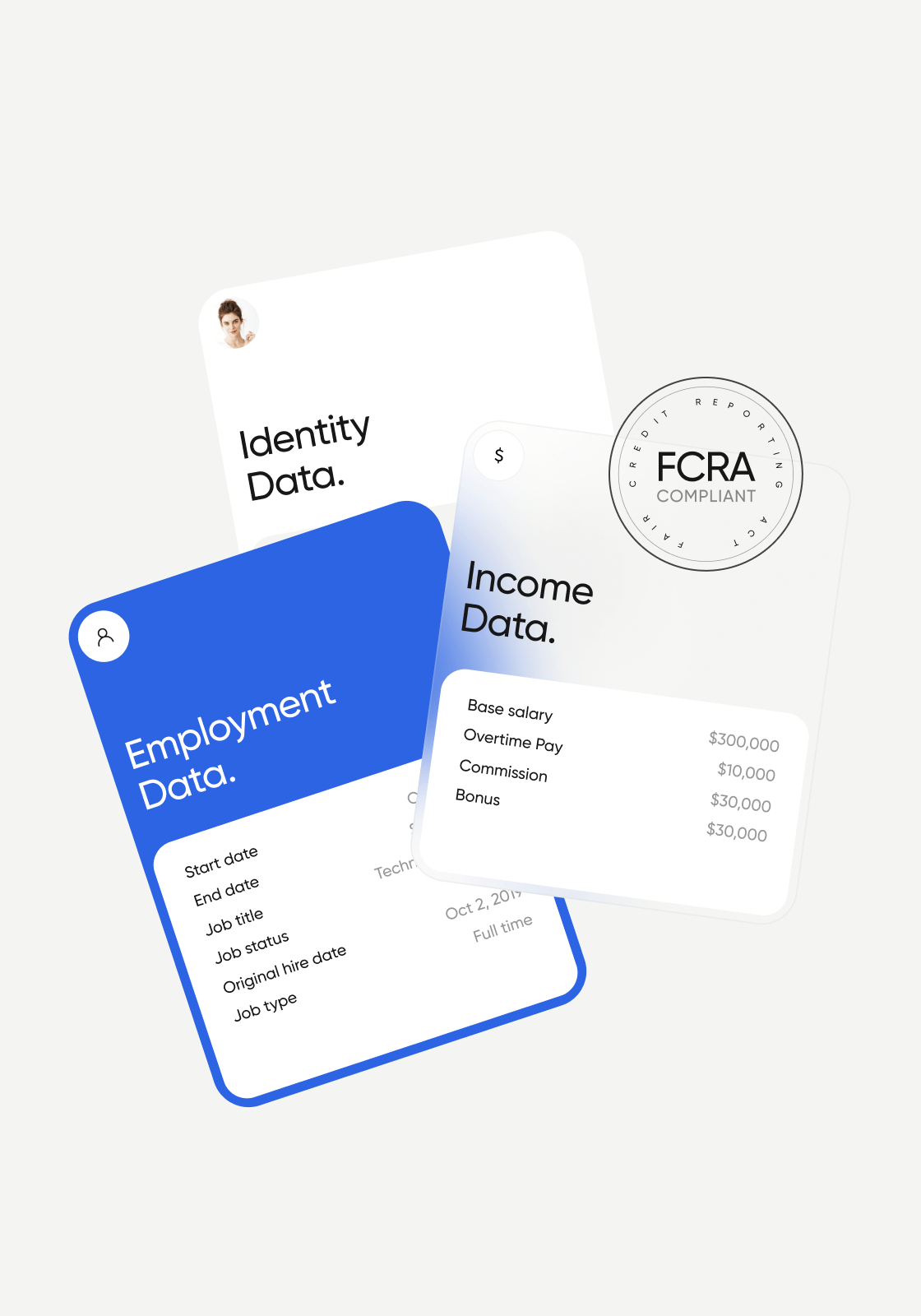

FCRA compliance

Market-leading data quality.

95%

Of traffic through

APIs.

90%

Fill rates for

mandated fields.

All-in-one platform for verifications.

All-in-one platform for verifications.

Mortgage Lending

Accelerate loan closing & reduce buy backs.

Home Equity Lending

Truv instantly verifies income, employment & insurance.

Consumer Lending

Approve more loans. Reduce repayment risk.

Auto Lending

Instantly waive income stipulations.

Tenant Screening

Avoid income fraud. Accelerate approvals.

Background Screening

Fast and affordable employment verifications.

20K+ integrations

Every type of income.

Every type of income.

How it works.

How it works.

Verifications by payroll FAQs.

Verifications by payroll FAQs.

Truv’s payroll verification service allows businesses and organizations to verify the employment and income details of workers quickly and securely with coverage spanning 96% of the US workforce. It helps employers, lenders, and other institutions verify an individual’s payroll data to assess things like employment status, salary, and employment history. This service typically integrates with a company’s existing payroll systems, allowing it to automatically retrieve and authenticate payroll information without needing the employee to provide paper documentation. This streamlines the verification process, reduces the risk of fraud, and saves time for all parties involved, especially in situations like loan applications, background checks, or renting.

Truv is an authorized report supplier for Fannie Mae’s Desktop Underwriter® (DU®) validation service and an approved provider of Freddie Mac’s Loan Product Advisor®(LPASM) asset and income modeler (AIM). Offered as fallback solution to payroll VOIE, Truv offers an AI-driven Document Upload solution. As an integrated provider with Freddie Mac’s AIM Check API, Truv can deliver instant and automated assessment of paystub and W-2 data for lenders to use for their calculations of qualified income.

Truv serves a range of industries including mortgage lending, home equity lending, consumer lending, personal lending, auto lending, retail banking, background screening, and tenant screening.

Truv covers a wide range of employment types, including full-time, part-time, gig, self-employed, retirement, benefits recipients, and more. The platform supports verifications across various industries, with the ability to connect more than 2.3+ million working professionals directly to their income source(s) in seconds.

Truv returns a complete report, JSON, and source documents, including original paystubs and W2s directly from the payroll provider.

Truv’s employment verification empowers consumers to connect their financial institutions in under a minute on average. Truv Reports are returned instantaneously.

Truv’s payroll income and employment verification solution is differentiated in the market with leading coverage that spans 96% of the US workforce, leading range of mortgage platform integrations, including loan origination systems (Byte, Empower, Encompass) and point-of-sales (nCino, Floify, LenderLogix, Lodasoft, BeSmartee), and GSE certifications across payroll VOIE and our payroll VOIE fallback solution, Document Upload.

Truv safeguards consumer data through multiple security and privacy measures, including operating as a credit reporting agency (CRA) and adhering to Fair Credit Reporting Act (FCRA) standards, implementing SOC2 Type II compliance protocols, utilizing application-level encryption to protect sensitive information, maintaining compliance with privacy regulations, and performing continuous security monitoring to identify and address threats in real time. This approach eliminates the need for consumers to email sensitive financial documents directly to lenders or landlords, reducing the risk of data breaches and unauthorized access to personal information.

Yes, Truv provides configurable reports that can be customized by Templates to meet specific institutional needs, allowing for flexible and tailored income and employment verification documentation, including the number of paystubs and W2s returned.

Truv’s income and employment solution fits seamlessly into lender workflows. With a no-code implementation, lenders can go live in days within a range of LOS platforms: ICE Encompass, BytePro, and Dark Matter Empower. Truv works out-of-the-box in a range of point-of-sales: nCino (FKA SimpleNexus), BeSmartee, Floify, LenderLogix, & Lodasoft.

Justin Venhousen

COO at Compass Mortgage