Assets

Verify borrower’s assets in seconds.

Streamline underwriting and reduce time to close with bank-validated insights.

Make informed decisions.

Make informed decisions.

Implementation

Streamline lending.

Minimize dependency on doc uploads and manual reviews.

Learn more

reduce buybacks

Authorized reports for DU® and LPA®.

Truv VOIE reports are approved by Fannie Mae and Freddie Mac to use with DU and LPA.

Conversion

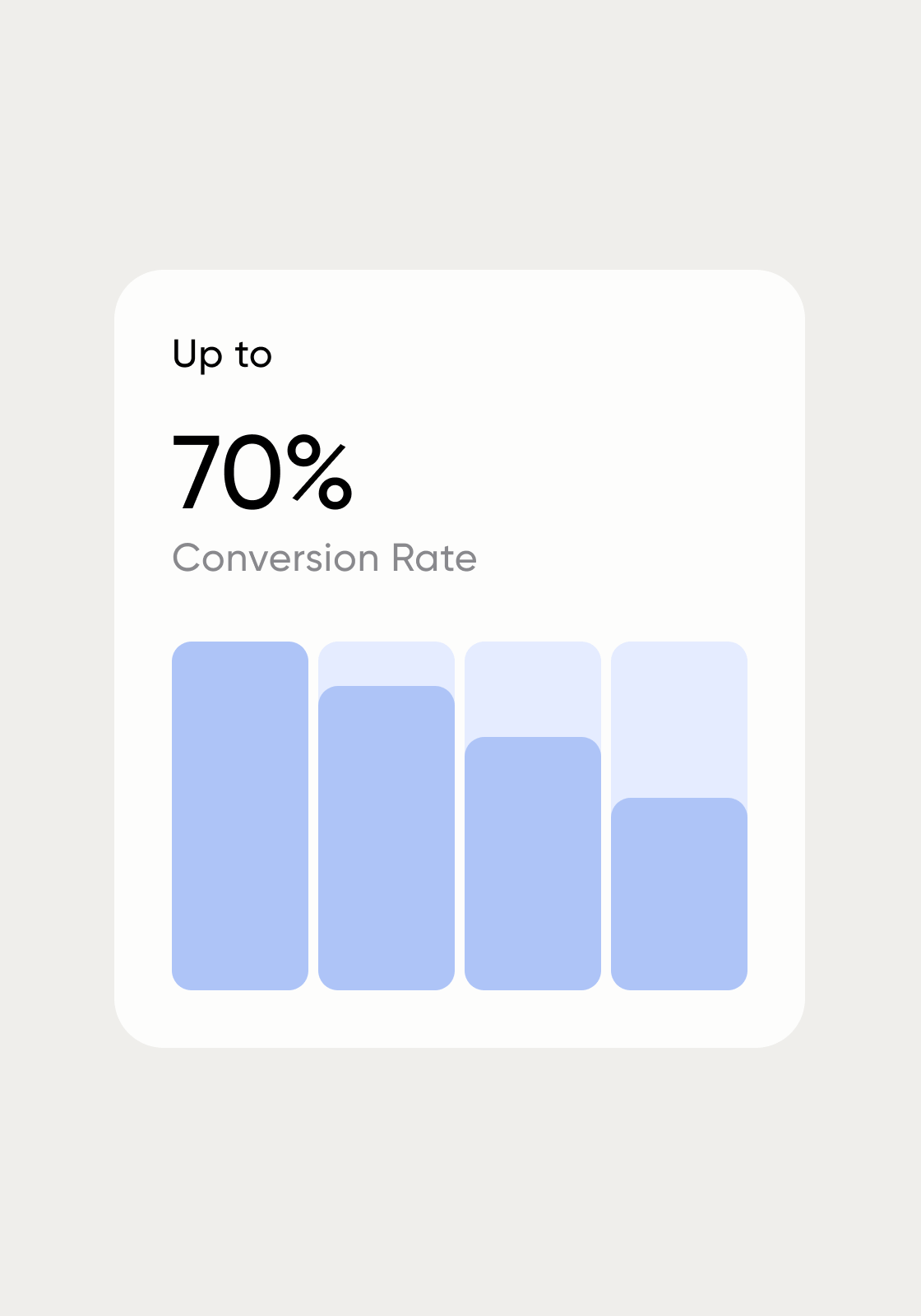

Phenomenal pull-through.

Strong consumer adoption and high pull through rates.

Learn more All-in-one platform for verifications.

All-in-one platform for verifications.

Products & Solutions

Payroll Income & Employment

Highest conversion rate and data fill rates in the industry.

Paystubs & W-2s

Best-in-class OCR and fraud detection for pay documents.

Mortgage Lending

Accelerate loan closing & reduce buy backs.

Home Equity Lending

Truv instantly verifies income, employment & insurance.

Platform

How it works.

How it works.

Asset verifications FAQs.

Asset verifications FAQs.

Asset verification for lenders is the process of confirming a borrower’s financial assets during loan approval to assess their financial stability and repayment ability. It involves verifying bank accounts, investment portfolios, retirement accounts, and other liquid assets to ensure the borrower has sufficient funds.

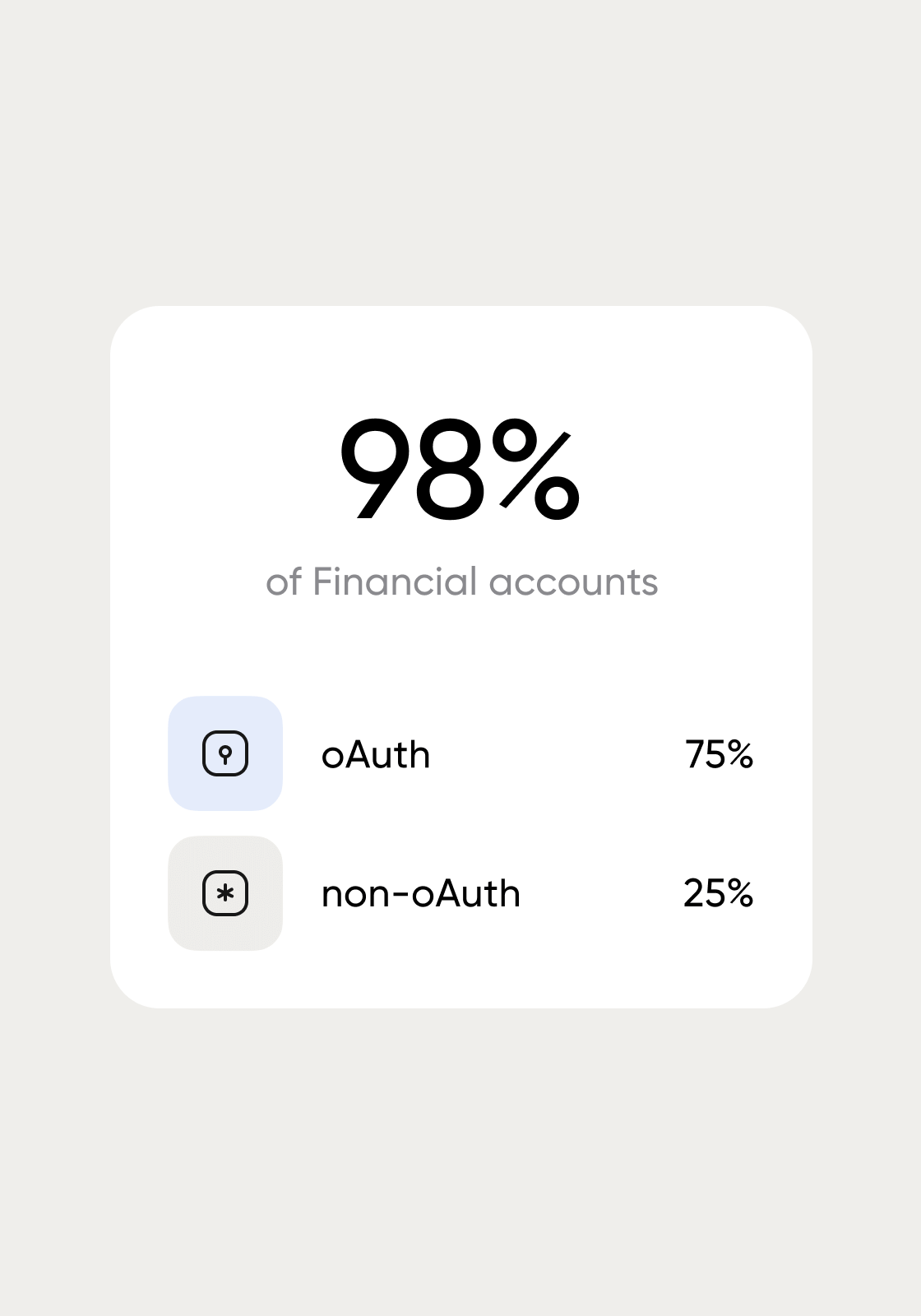

Truv provides instant asset verification with direct bank-validated insights, offering comprehensive asset information in seconds with robust security and OAuth credentials protection.

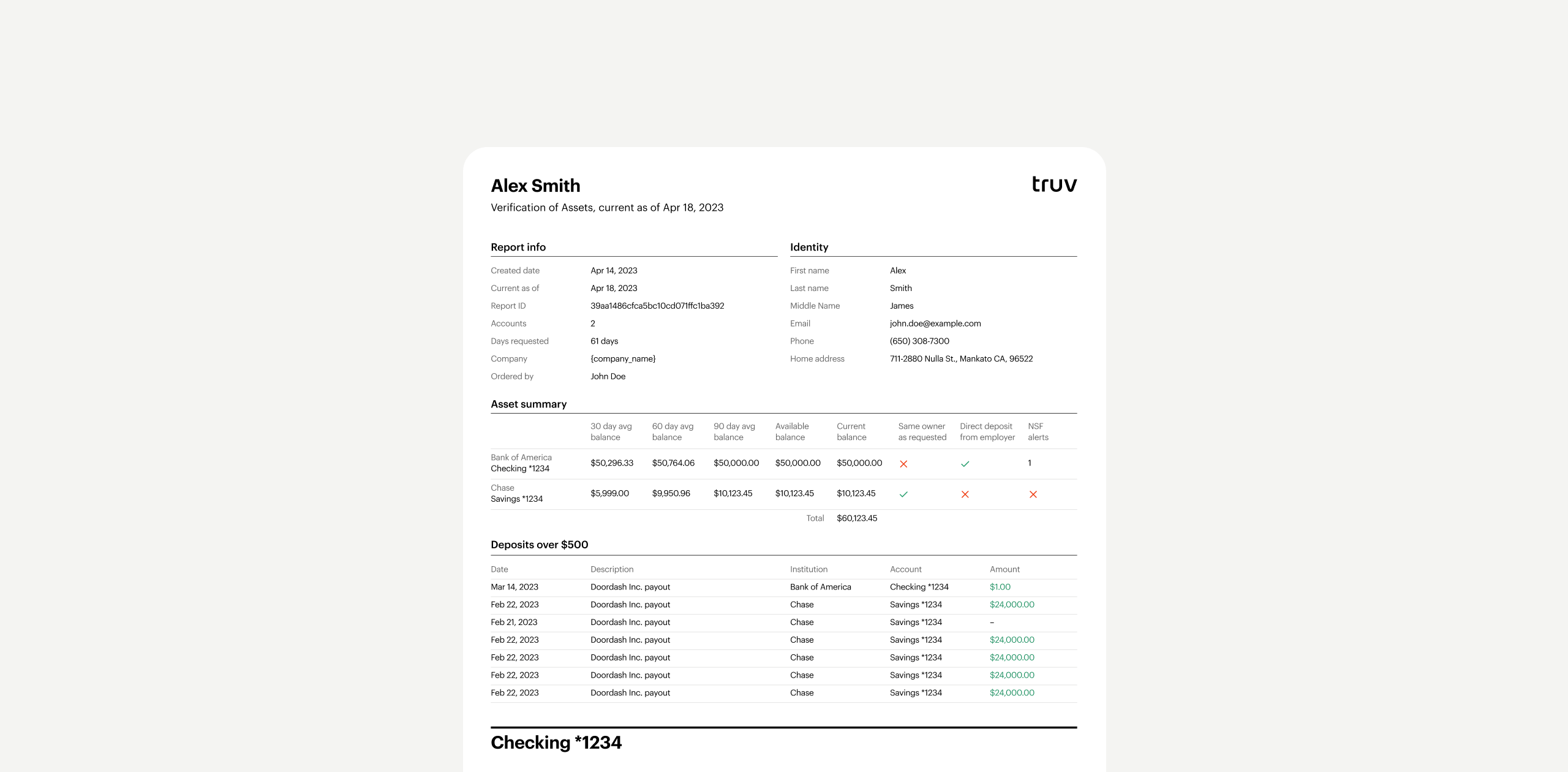

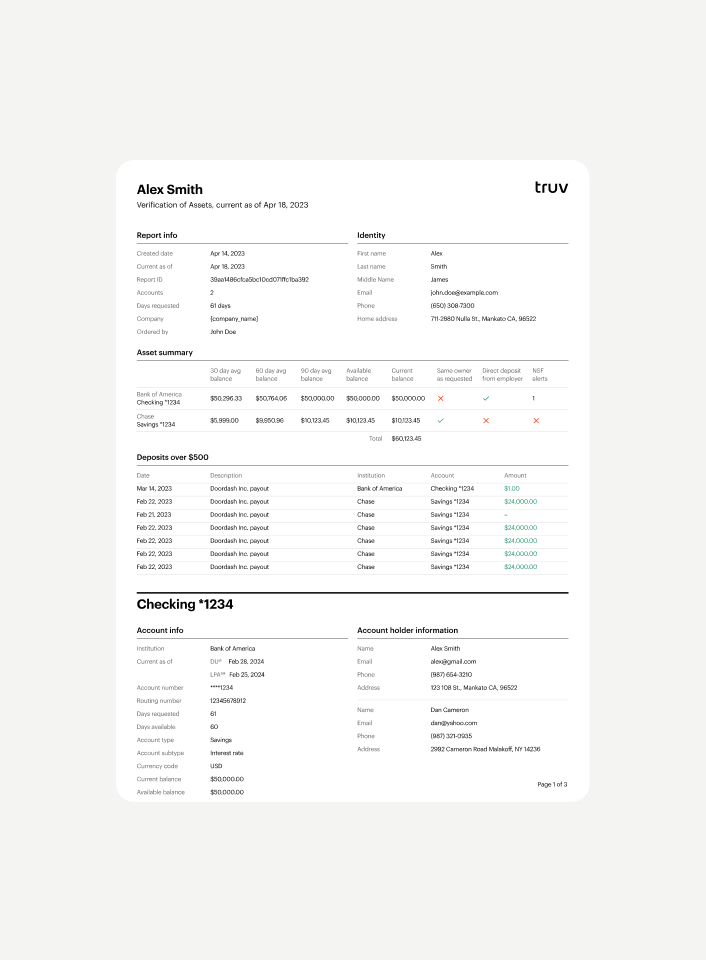

The platform provides a complete asset summary, including current balance, available balance, 30-day and 60-day average balances, and transaction flagging for direct deposits, rent/mortgage payments, recurring payments, and large transactions.

Users can customize reports with configurable options like days of history, extended history lengths up to 2 years, and custom thresholds for large deposits and withdrawals.

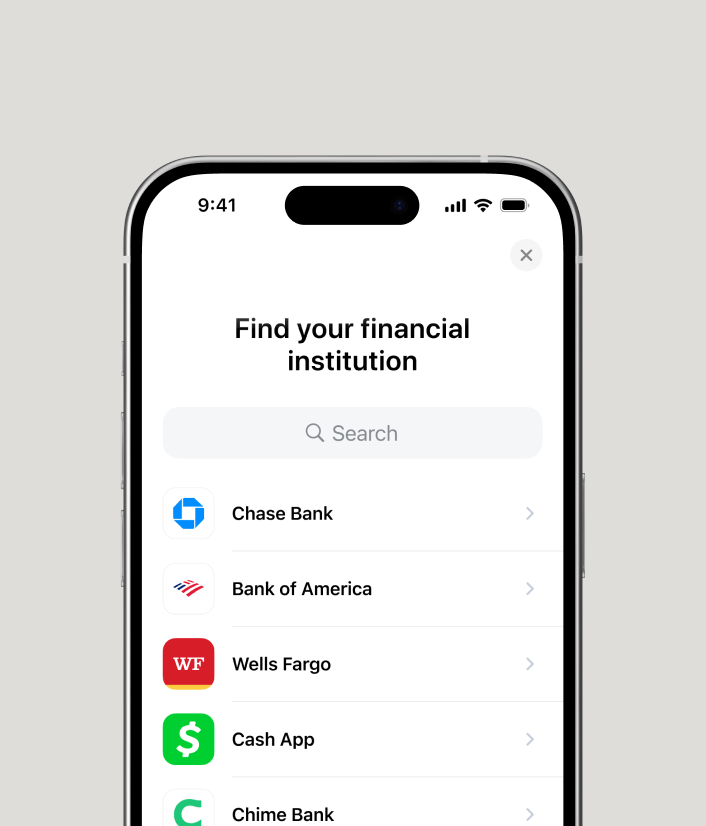

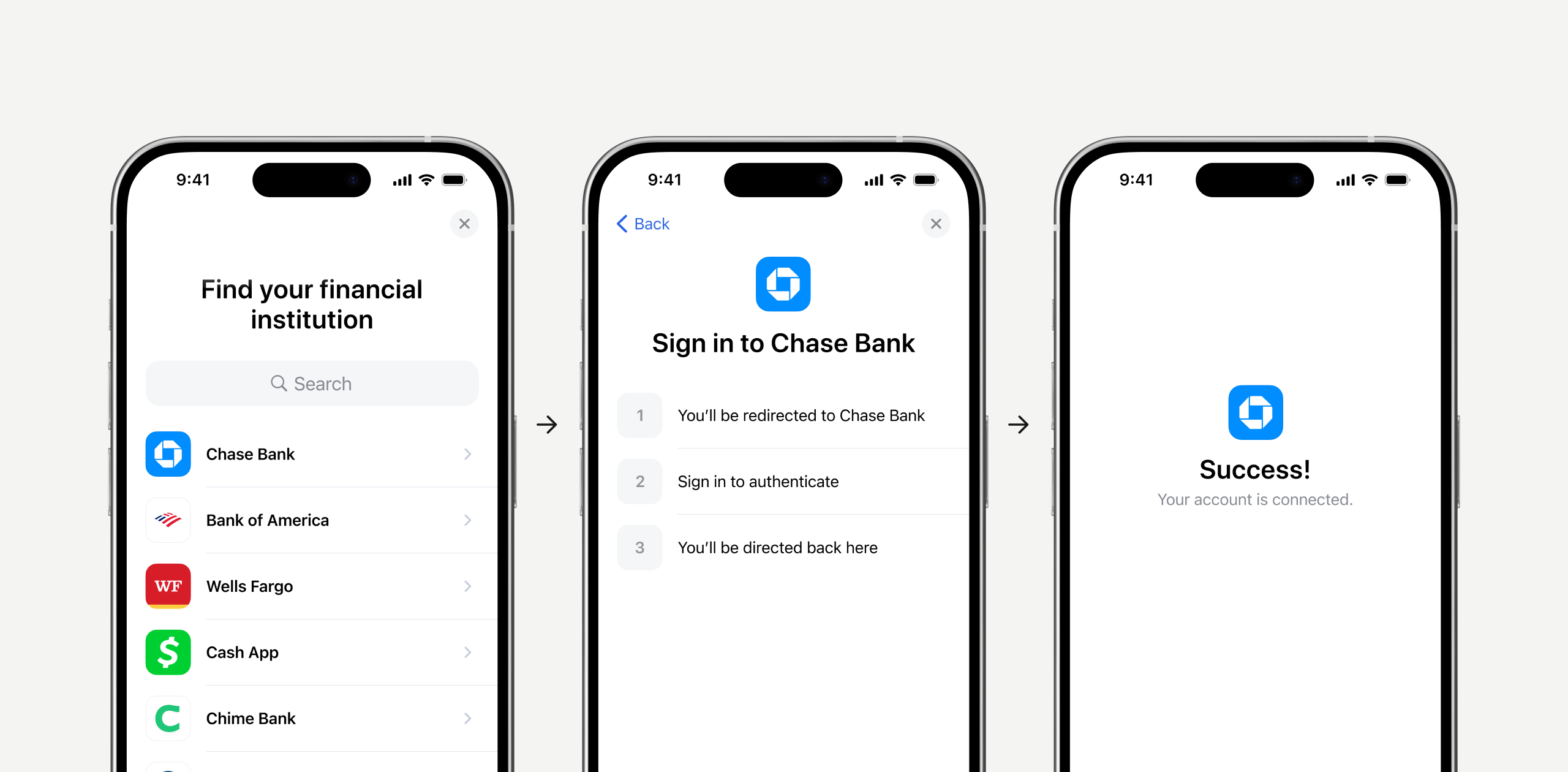

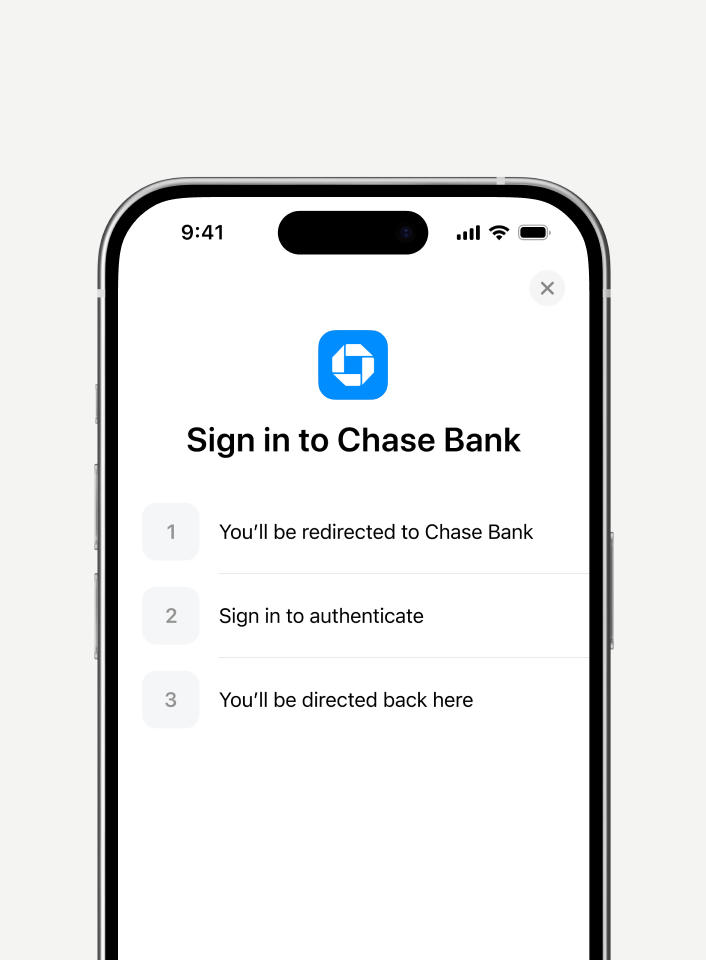

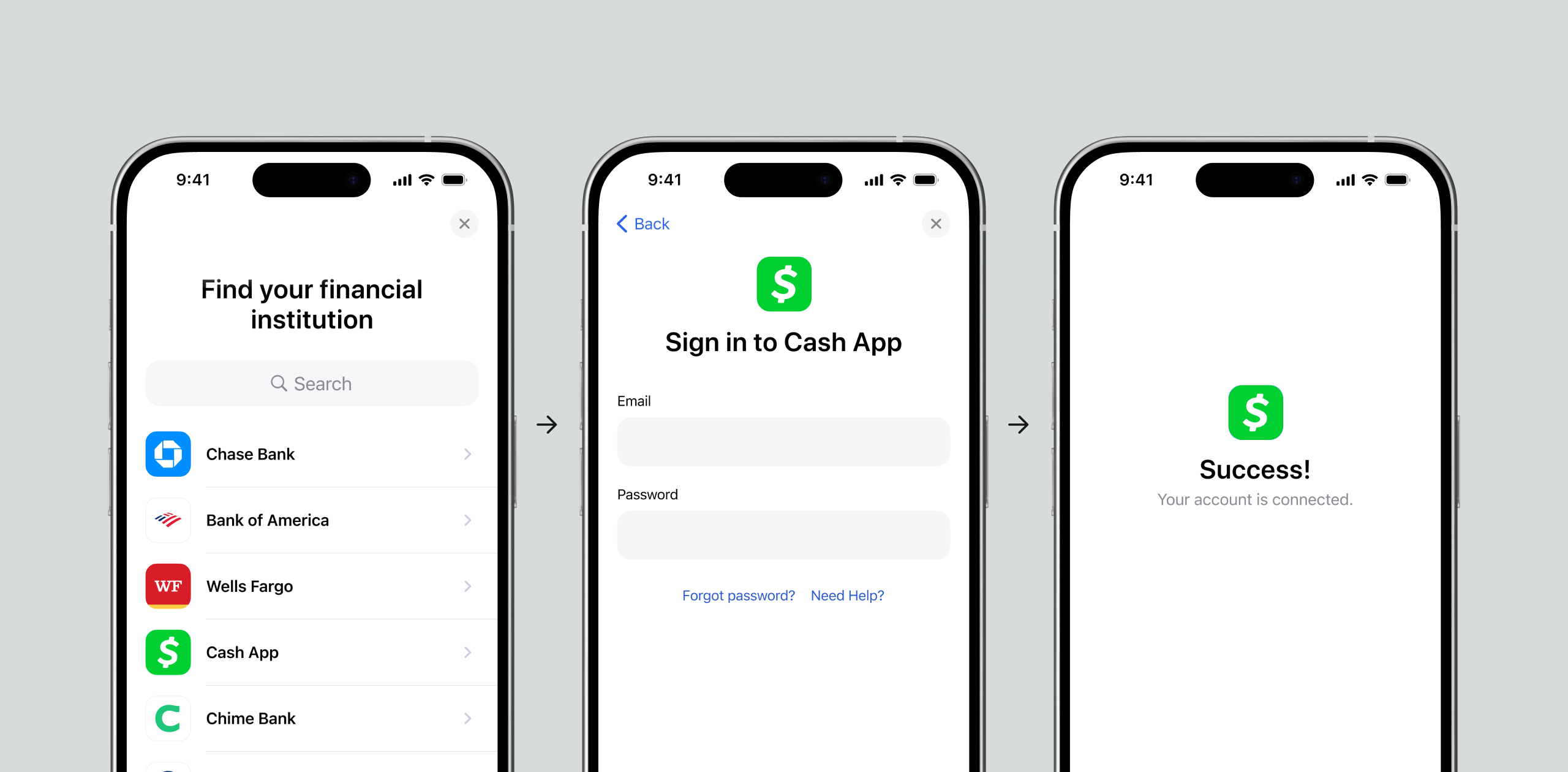

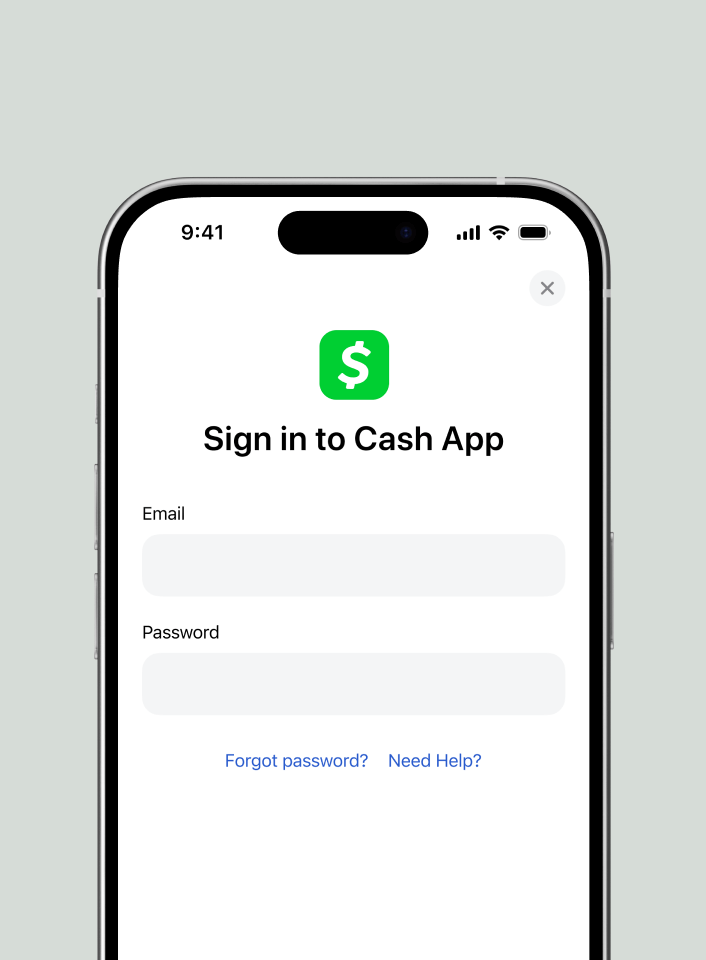

Truv Asset Verification enables borrowers to connect their financial institutions in under a minute on average. Truv Reports are returned instantaneously.

Truv Asset Verification helps streamline underwriting, reduce time to close, minimize manual reviews, and increase the number of borrowers connecting to financial accounts for a faster, easier verification process.

With a seamless UI and extensive coverage, Truv has optimized the borrower experience, making the connection to financial institutions fast — under 1 minute — and easy — just a few clicks.

Richard Plummer

EVP of Operations at Orion Lending